Date Published 09 February 2021

From a report taken from Zoopla today it is reported the the annual UK rental growth increases outside London.

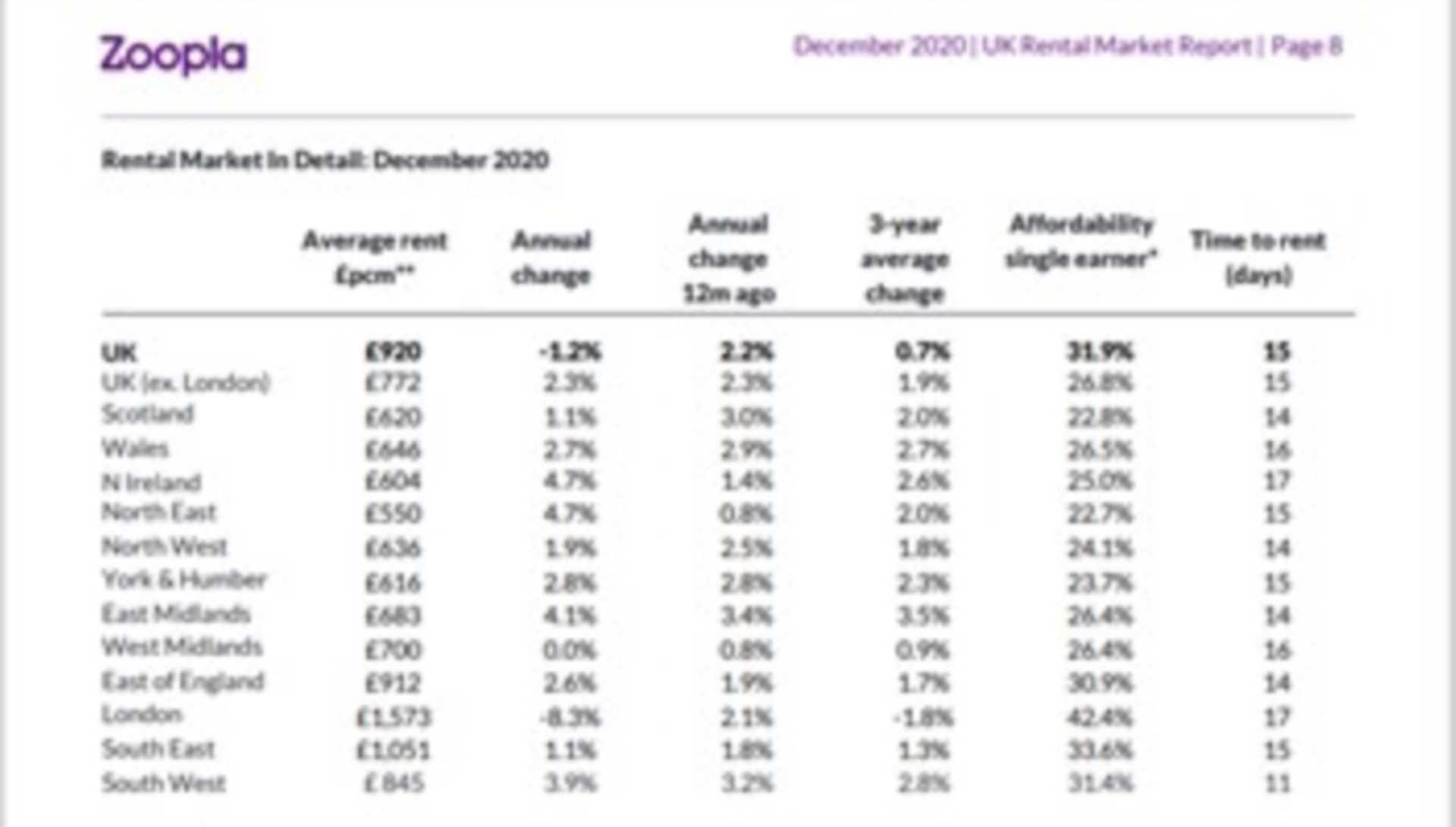

Average rents across the UK excluding London rose by 1.4% in the three months to the end of December, taking the annual growth in rents to 2.3%. This compares to rental growth of 1.6% seen at the end of Q3 last year. Rents are rising year-on-year in most regions across the UK, with the exception of the West Midlands (0%) and London.

Average rents in London continue to fall. Rents declined by -2.5% in Q4 2020, taking the annual fall to -8.3%, nearly matching the rental declines seen in the aftermath of the Global Financial Crisis in 2008. Average rents in London are at levels last seen in 2014.

Demand and supply

Across the UK, demand for rental property is still rising, with total demand from renters in January some 21% higher than the same month last year. At the same time, the supply of homes to let is more constrained, falling by 11% over the same period, and putting upward pressure on rents in many areas.

Demand in some well-connected towns across the country is putting particular upwards pressure on rents, with rental growth of more than 7% seen during 2020 in Rochdale (+8.2%), Hastings (+8.0%) and Mansfield (+7.1%). This trend is reversed in London, as rental supply outpaces demand, as more stock continues to come back to the market amid the changing working,

commuting, tourism and business travel trends prompted by the COVID-19

pandemic and subsequent lockdowns.

Market outlook

The pandemic has disrupted some of the key drivers of demand in the rental market – including labour mobility, migration and employment growth. Despite this, we have seen a rise in localised demand in some areas, as some renters look to relocate.

The outlook for the rental market, especially in central cities, will depend on how quickly the COVID-19 vaccine is rolled out, and how quickly it can start to have an effect and kick-start a return to more mobility across the country and internationally.

As this happens, ‘business as usual' will start to resume in city centres as business activity starts to rise, from the reopening of retail and offices to events spaces, leisure and entertainment facilities. This will likely result in tick-up in demand in city centres, as well as a shift from long-term lets back to short-term lets in some cases, helping to absorb some rental stock - particularly in London.

Flexible working is likely to continue, meaning there may be a permanent shift in priorities for some renters in terms of location and property type. The ‘search for space' will likely continue, supporting the rental market for family houses.

At a more macro level, rents will be underpinned by continued demand in the sector as lack of mortgage availability for first-time buyers mean some stay in the sector for longer. In addition, the supply of new homes into the sector from buy-to-let landlords will remain constrained, meaning overall UK supply in this sector will remain limited which will act as a continued support to rental levels.

We at Lewis Dean being set on the South Coast are seeing rental properties being re-let before a current tenant has even vacated meaning no loss of income for landlords or Void periods, we have have an extensive database of registered tenants waiting to move in Poole.

If you are a Landlord in Poole, Upton, Hamworthy, Creekmoor or Lytchett please give me a call as we can quickly and confidently let your property, call me on 01202 621900